James McClendon, Asst. News Editor

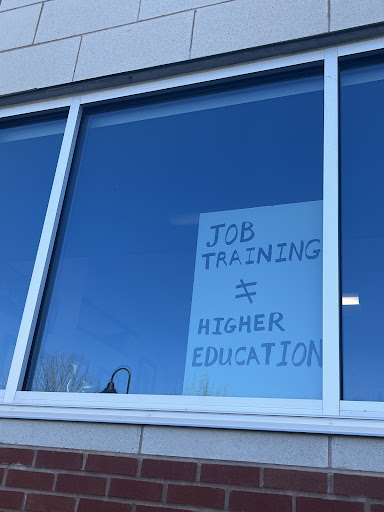

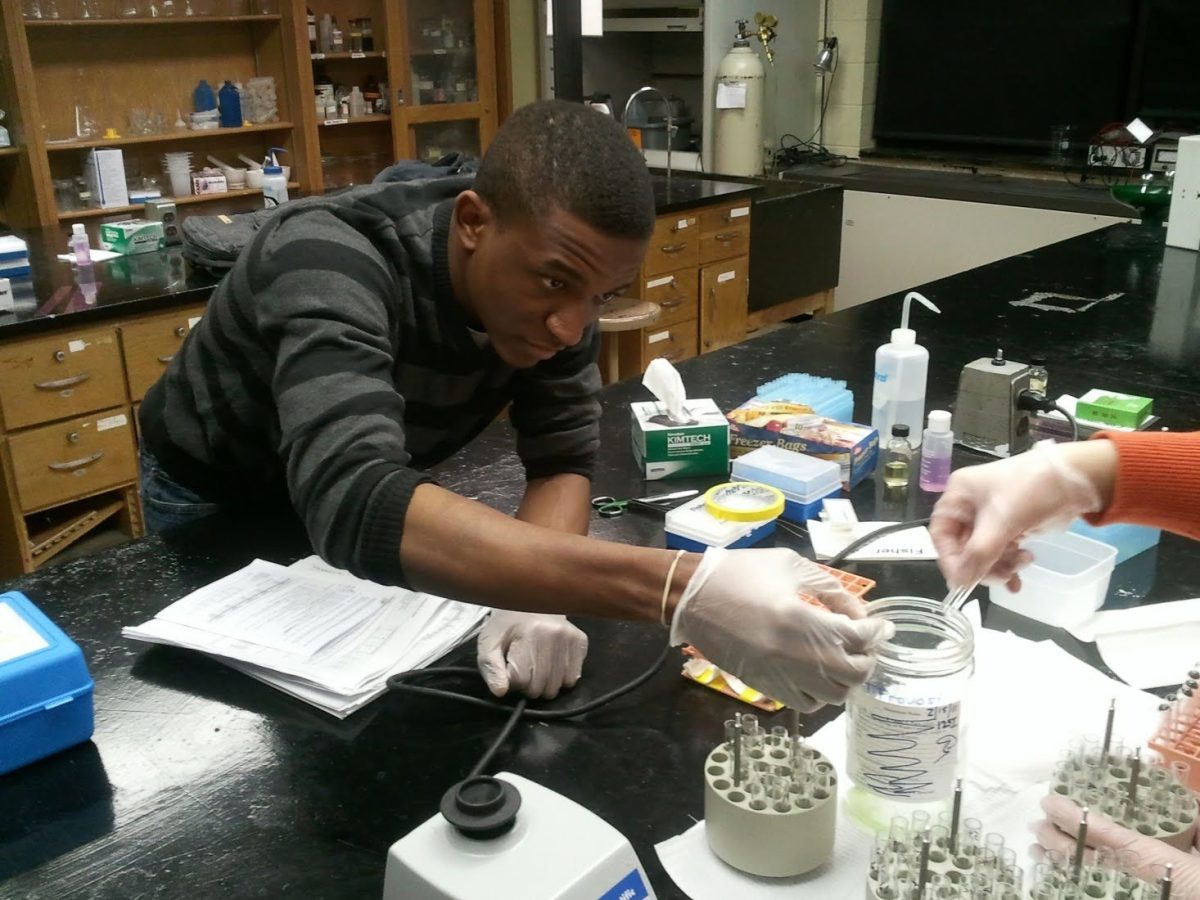

As Utica College seniors prepare to move to the next phase of their lives it is important for them to fully understand how to handle the financial responsibilities that come with attaining their degrees.

The most important step students will take in this process is going to talk to their advisor about what they need to do.

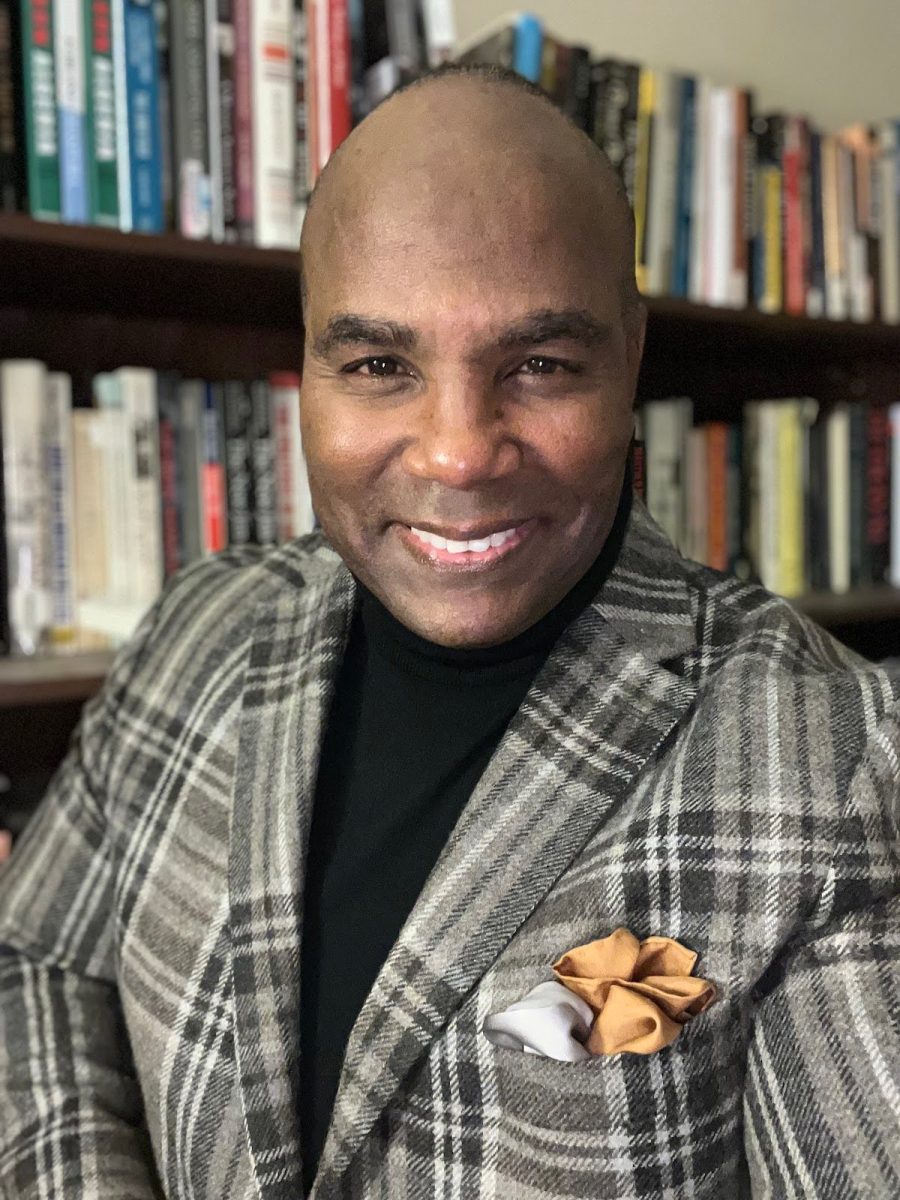

UC alumnus George Schultz graduated in 2012 with a degree in construction management.

“I went to my advisor and she helped me figure out what I would need to do to be in a position to pay off my student loans,” Schultz said. “I had no idea how to even begin the process until I met with my advisor.”

Students who received subsidized, unsubsidized or plus loans will be required to complete exit interviews before they graduate.

Students who have applied for graduation will be sent certified letters notifying them of their exit interview requirements. These letters are generally mailed out in early May.

After this notification, a hold is placed on the student’s account, making the student’s transcripts and diploma unavailable until completion of the interview.

“It’s best to complete counseling as soon as possible after receiving notice,” Stephanie Bonk, a student financial services counselor, said.

Students will need to know their FSA ID and password to log into www.studentloans.gov. They will complete the exit counseling session on this web page.

The Federal Student Aid website is a great tool for all students. It allows them to access detailed information about their total federal loan debt, who their loan servicer is, repayment and consolidation options, forgiveness programs and what to do if they are having difficulty making payments.

The session will take anywhere from 30 to 45 minutes.

Exit counseling provides students with the information they need to repay federal student loans.

To complete the exit counseling session students will be required to provide information that will be added to their loan records. Students will provide names, addresses and phone numbers for family members, two references currently living in the United States and a future employer.

The exit counseling is designed to put students on the right financial path after school. Students will need to provide information about their anticipated earnings and expenses.

“Borrowers can get an idea of what their budget may look like and maybe start thinking about making adjustments,” Bonk said. “But nothing is set in stone.”

If students have any questions about the exit interviewing process they should contact an advisor from the office of Student Financial Services or log on to the Federal Student Aid website.

![President Todd Pfannestiel poses with Jeremy Thurston chairperson Board of Trustees [left] and former chairperson Robert Brvenik [right] after accepting the universitys institutional charter.](https://uticatangerine.com/wp-content/uploads/2023/10/unnamed.jpeg)