Michael Muon, Staff Writer

New York State launched the Get on Your Feet Loan Forgiveness Program on Dec. 31, 2015. This program provides up to 24 months of federal student loan debt relief to recent NYS college graduates who are enrolled in the income-driven repayment plan.

This plan generally calculates the repayment plan based on 10 percent of the borrowers income. If the college graduate is accepted into this program, 24 months of payments calculated from the income-driven repayment plan will be paid directly to the borrower’s federal loan servicers.

However, there are certain stipulations to be met to be eligible for this program. According to the Higher Education Service Corporation web page, an applicant must: be a legal resident of New York State and have been a resident for 12 continuous months, be a U.S. citizen or eligible non-citizen, have graduated from a New York State high school or received a New York State high school equivalency diploma, have earned an undergraduate degree from a college or university located in New York State in or after December 2014, have earned no higher than a bachelor’s degree at the time of application, apply for this program within two years of receiving an undergraduate degree, be enrolled in the federal Income Based Repayment plan or Pay as You Earn plan, have a primary work location in New York State if employed, have an adjusted gross income of less than $50,000, be current on all federal or New York State student loans, be current on the repayment of any New York State award, and be in compliance with the terms of any service condition imposed by a New York State award.

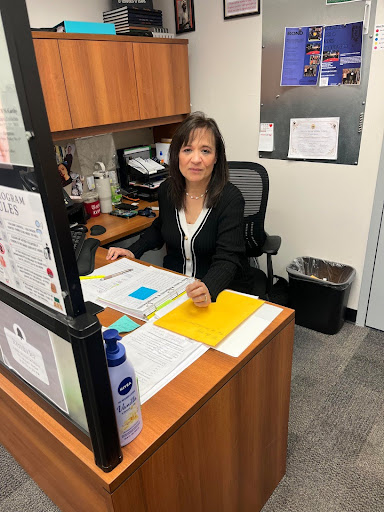

Executive Director of Student Financial Services Laura Bedford said college is costly.

“The average federal debt for a Utica College student is in the range of $27,000,” Bedford said.

New York State cares about college students and wants graduates to become more engaged in their lives and not worry about loans as much with this help. To help eligible students take advantage of this program, UC has mailed out postcards to every eligible graduate who graduated between May and December to inform them of this opportunity. UC will also be informing students about it during their exit counseling.

UC Alumni Bria Hilliard said this program will be a great help to herself and peers.

“After four years of hard work, it’s annoying when those emails start to come in reminding you about your balance and when your have to make that first payment,” Hillard said. “Knowing that there is now a program that can help put a dent in those loans, I believe it will give students the encouragement to take out the extra money if they need it. A huge reason why people do not take out loans is because of the fact that eventually they will have to pay it back with interest.”

It’s unclear on how long this program will be continuing but it’s clear that Hilliard, who meets the qualifications, is applying for this program.

UC alumni Michelle Klien thinks that the forgiveness program will be very helpful.

“I just think that maybe they could have gone back further than December 2014 graduates to help more people since so many students are in such a great amount of debt when they graduate college,” Klien said.

Well, it’s clear that the forgiveness program is a great start to helping students with their education and that New York values education.

The college investor web page currently states that all states in the U.S. have at least one loan forgiveness program except for Alabama, Connecticut, Tennessee, Utah, and West Virginia.

New York State currently has nine Loan Forgiveness Programs.

For more information on other programs sponsored by NYS visit College Investor.

![President Todd Pfannestiel poses with Jeremy Thurston chairperson Board of Trustees [left] and former chairperson Robert Brvenik [right] after accepting the university's institutional charter.](https://uticatangerine.com/wp-content/uploads/2023/10/unnamed.jpeg)