Michael Muon

Staff Writer

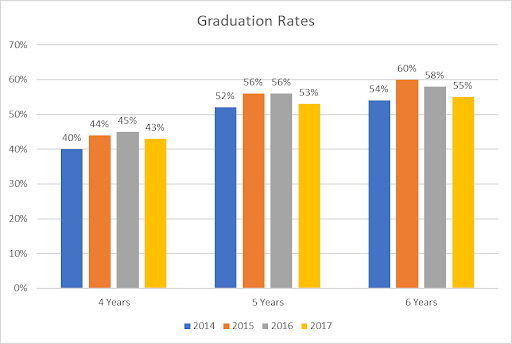

Before the tuition cut the average total loan amounts for a Utica College student is $51,732 after four years according to College Factual. A majority of students at Utica College are either working off campus or involved in a work study job that pays minimum wage and are getting paid bi- weekly. The current minimum wage is $8.75 and according to college data, the average hours workedbycollegestudentsis 8-12 hours, allowing students to earn about $210 before taxes if they work 24 hours in one week.

It is difficult for college students to save; however there are tips and guidelines to set them up and teach students the responsibility of saving.

A tip to saving money for college students could be with their coffee intake since some college students love coffee or a latte in the morning. These are, in fact, minor costs that students don’t think about, but this minor cost does add up and makes a difference. The savings in a morning coffee could be obtained by students learning how to brew their coffee. On the bright side, students can make their serving as big as they want.

“Don’t settle for bad deals and take advantage of

coupon booklets when shopping for groceries,”

-Lewis Luis

Student textbooks are expensive, so instead of buying it from the college bookstore that will charge you an obnoxiously large amount, search online on websites like Craigslist, Amazon, and EBay for used books. The Internet has made this very easy to do and then after the end of the semester students can sell their textbooks to others students.

Another tip is to cut back on the amount of takeout that students order. Learn the art of microwave cooking. Buy frozen meals and learn the correct strategy to cook meals in your microwave. There are tons of ways to cook everything from bacon and eggs to hamburger helper.

Sophomore Yamilette Baez suggests that students track their expenses to see where their money goes. Baez suggests saving all receipts and making an excel spreadsheet to create a visual of where a student’s spending may go. With this spreadsheet, students can add all of their money spent, and with the total, nd expenses that they can cut out of their budget.

Freshmen Lewis Luis advises students to be alert with deals when shopping for groceries, clothes, and activities.

“Don’t settle for bad deals and take advantage of coupon booklets when shopping for groceries,” Luis said.

Use coupon apps such as Groupon, Retailmenot, and Living Social to help nd the best deals.

Junior Jonathan Fitzgerald- Bord also offers good suggestions and alternatives for students to help save money. Fitzgerald-Bord advises that students resist the urge to buy snacks or food outside their meal plan. Fitzgerald-Bord says to take advantage of the meals that students already paid for that are quite expensive.

Fitzgerald-Bord adds that students don’t need to always buy those new shoes, clothes, etc. Limit yourself; know the difference between your needs and wants.

Fitzgerald-Bord also says, vending machines are a rip- off, and wants students to buy their snacks in stores and buy them in bulk because this way cheaper.

College students already stress enough about classes and deadlines, so why make money another problem? Use these tips to get on the road of saving for the important things that are needed in the future.

![President Todd Pfannestiel poses with Jeremy Thurston chairperson Board of Trustees [left] and former chairperson Robert Brvenik [right] after accepting the university's institutional charter.](https://uticatangerine.com/wp-content/uploads/2023/10/unnamed.jpeg)