On Monday, April 12, Finnish exchange student Sofia Westling gave a presentation on the differences between Finland and the U.S. social security systems via Zoom.

This presentation was open to all members of the Utica College community and highlighted some major differences between the two countries’ approaches to social security, but most notable were differences for students.

According to Westling, Finland, affectionately called “The Land of a Thousand Lakes” (due to the 180,000 lakes the small country is home to), has one of the most advanced social security systems in the world – a system that guarantees decent living conditions not only for native Finns but for anyone who calls Finland home.

Recent Posts

- Slashed SGA budget sparks student frustration at recent meeting

- Editorial: Your campus, your voice – How to reach us when you want to speak out and how we make editorial decisions

- Op-Ed: Why Black student perspectives matter in campus reporting

- Conservative activist Charlie Kirk’s death shocks Utica University students

- Op-Ed: Utica student looks to start new multi-faith discussion group on campus

“Our social security system covers the entire population, and is not limited to any specific groups,” Westling said.

Senior Audra Williams, who planned to do an exchange semester in Finland prior to COVID-19 making that impossible, said she was surprised how different the systems between the two countries were after seeing the presentation.

During her presentation, Westling spoke of the benefits offered to students in Finland by the government.

“Through [the government agency] Kela, the government makes payments to students,” Westling said. “This is to provide economic security to students, and it means that anyone can attend university if they wish to.”

Westling said the government provides students with a monthly $300 study grant, provides over $700 a month in government-backed loans and pays about 80% of students’ housing.

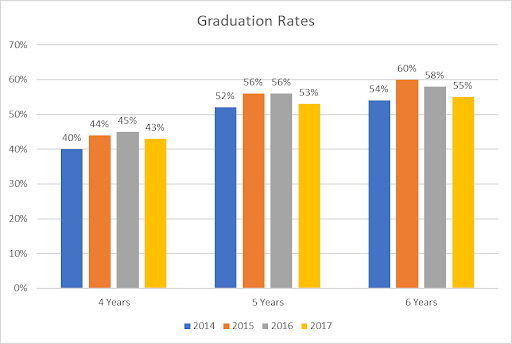

The average amount of student loans a student in Finland will graduate with is $12,342.62. This is less than half of the average American’s student loan debt, which sits at around $29,000.00.

Furthermore, if a student graduates on time, they can be eligible for student loan compensation. This means that Kela will pay back around 40% of your student loan debt.

“Students also have certain medical plans especially for them,” Westling said. “If they pay around $40 per semester, they have unlimited free healthcare for as many visits as they need.”

Without the student health benefits, the highest amount a person will pay for a single visit is $24.54, and the cost a patient is charged with is calculated by the ability to pay.

Williams said she was shocked by how much assistance was provided to students in Finland.

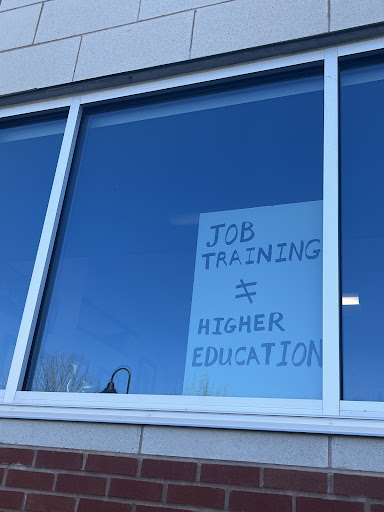

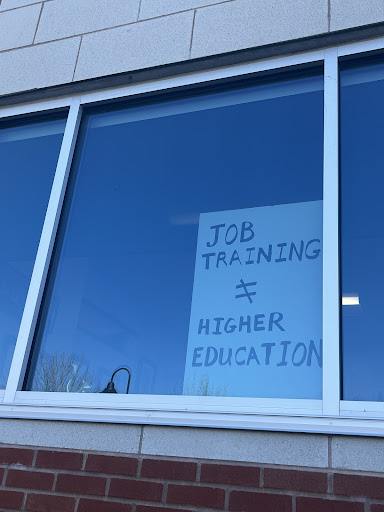

“Given that here in the U.S. we pay for just about everything when it comes to college, it sounds amazing to not pay so much,” Williams said. “The stress that comes with student loans makes finding a job after graduation one of the main stressors. And if we don’t have jobs right away after college then it’s like our time has failed because we spent so much money on our degrees.”

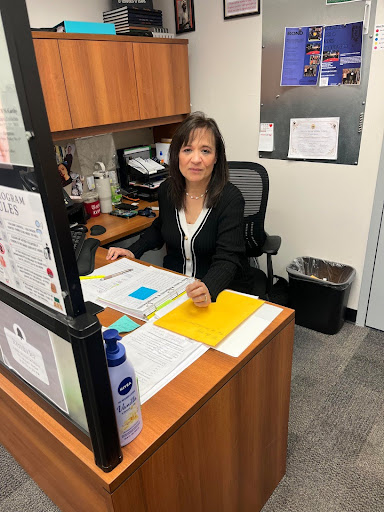

Stacy Phelps, coordinator of international education at Utica College, said that often while the U.S. is an appealing place for international students to attend college, most are shocked at the lack of student benefits and affordable healthcare.

“I definitely think the U.S. should do more to support its students,” Phelps said. “Some students don’t have the means to health access and other benefits, so if there was more support it’d help students succeed inside and outside the classroom too.”