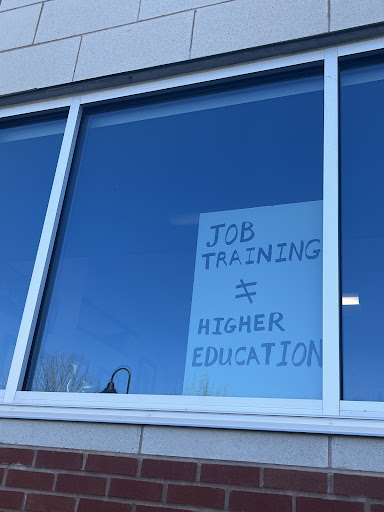

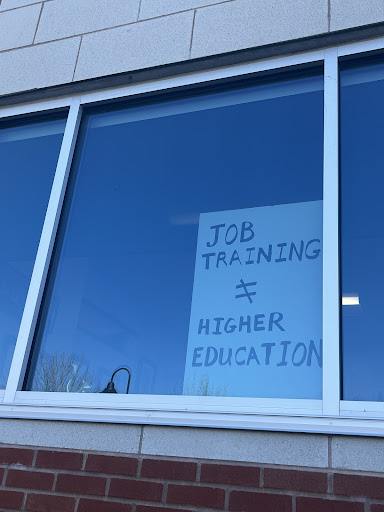

The latest student loan debt statistics indicated a number of $1.56 trillion in collective student loan debt which is second in consumer debt totals only behind mortgage debt, yet higher than auto and credit card loans. The average debt collection for students in 2018 was $29,200 for the Class of 2018, according to Forbes writer Zack Friedman, which was a 2% increase from the previous year.

Now, Democrats are devising a plan to forgive up to $50,000 in loans per student. This would make a reported 14.4 million borrowers completely debt-free. This number has increased since President Joseph Biden’s previous statement saying that he wanted $10,000 in loans per student canceled.

Both Sen. Chuck Schumer of New York and Sen. Elizabeth Warren of Massachusetts have called for executive action, according to CNBC writer Annie Nova, with Warren specifically stating student debt forgiveness as “the single most effective economic stimulus that is available through executive action.”

Schumer has recently pushed to cancel $50,000 per student. If the amount were $10,000 per student, the outstanding education debt in the United States would fall to $1.3 trillion, while $50,000 would decrease that amount to around $700 million. To add on, the plan would completely erase federal debt for 80% of borrowers.

“I think there is a decent chance he issues some loan forgiveness through executive action, perhaps starting with the Public Service Loan Forgiveness Program,” Political Science Professor Luke Perry said. “This well-intentioned program, which I’m in, has been a total mess, yet the pandemic has sparked significant changes and reforms that might provoke long-term policy consequences, like debt elimination.”

On Feb. 4, White House Press Secretary Jen Psaki said “Our team is reviewing whether there are any steps he can take through executive action and he would welcome the opportunity to sign a bill sent to him by Congress.”

Some publications have indicated the possibility of a tax bomb for borrowers, who may have to pay a sort of income tax as if the amount forgiven would be earned. However, writer Adam Minsky still indicates that this could be a plus for borrowers, who would pay less overall through tax rather than the full payment of their respective loan.

This initiative has recently come after the Biden administration indicated a third wave of the COVID-19 stimulus package, which, this time around, would include college students still labeled as dependent on their parent’s recent tax filings.

Opponents argue reduced cash flow, particularly over the course of the next five years. In a study from the Committee for a Responsible Federal Budget, eliminating $1.5 trillion in student loan debt would translate to $90 billion less to spend in 2021 and $450 billion less over the next five years. This is in proportion to capping loan forgiveness amounts by either $10,000 or $50,000.

“All public money comes from the same place: tax revenues,” Perry said. “Federal spending decisions are all always difficult. There are countless needs with various perspectives on what should be prioritized and only so much money different parties and members of Congress are comfortable spending.”

Opponents also argue about setting an example. Perry also noted, among the older generation, as an example, that they paid for their own college and/or paid for their children’s education and that current borrowers should be able to do the same. However, he indicated that the rise in college costs could be a direct challenge to this argument.

For those at Utica College, tuition costs around $10,000, which does not include fees. Most students living on-campus also have to pay charges of $3,000 for food and their room. Those choosing to live off-campus substitute their charge of room and board with rent, coming with various expenses and monthly payments.

However, Perry is also surprised about how perspectives on student loan forgiveness have changed or widened over the past few years.

“We are now in a situation under unified Democratic government where there is a real possibility of serious debt elimination,” he said. “I did not anticipate this as little as a month ago, prior to the Georgia run-off elections, which secured Democratic control of the Senate.”

Those in favor of the initiative, such as Animal Science major Katherine Hawley have indicated a societal emphasis on pursuing higher education. Hawley was raised in central Iowa, where, according to her, it is looked down upon to not attend college.

“So a lot of students who couldn’t afford to go to school did anyways, with the promise of landing good-paying jobs at the end of it,” she said. “That promise has been broken.”

The plan also affects Hawley, whose father is deep into the stock market.

“Although I do come from a place of privilege, my family is upper middle class and white, my college fund was in the market,” she said. “With the stock fluctuations over the summer, my plan for paying for school has pretty much disappeared, forcing me to take out loans I was not planning on when I decided to travel across the country and attend a private liberal arts school.”

Former student Shane Walpole indicates government spending in other sectors, such as oil. The timing of this initiative is what stands out to him the most.

“It’s coming at a time where the government is passing Covid relief to boost the economy, all while cutting various money-making initiatives such as the Keystone pipeline forcing the oil industry down to go to other sources of energy and forcing the US to rely more on other countries for oil,” Walpole said. “I’m no expert but it’s evident the administration is spending large sums of money on this by inserting a trillion dollars into various parts of the economy.”

Since Psaki’s Tweet on Feb. 4, President Biden’s administration seems to have not provided updated comments regarding the new plan.