The owners of the local doughnut shop chain Dippin’ Donuts have been indicted in a $1 million tax evasion scheme. Following initial investigations into their tax records in June 2018, the Rome-based family that owns the three stores in Oneida County are now facing criminal charges.

John, Helen and Dimitrios Zourdos have been charged with 16 felony counts of conspiracy to defraud the Internal Revenue Service, tax evasion, and aiding and assisting in the filing of false tax returns, according to federal prosecutors. In addition, officials say that the family hid more than $1 million in sales between 2013 and 2017 by depositing cash into their personal bank accounts as well as filing incomplete tax returns.

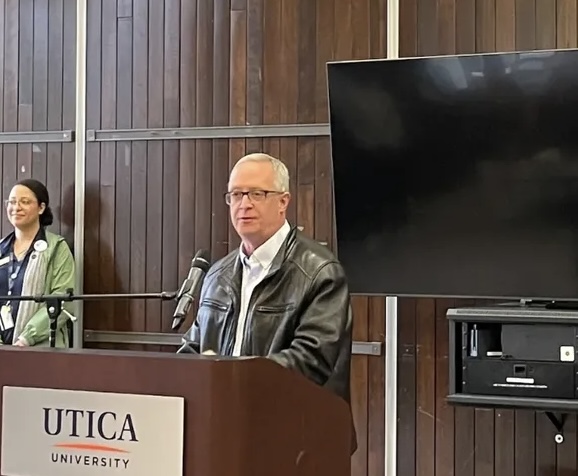

“Tax Evasion is one of three tax crimes that fall within the overarching category of tax fraud,” said Bernard Hyman, professor of practice-economic crime at Utica College. “Those three crimes are tax evasion, filing a false return and failure to file. Tax Evasion requires the government to prove that the defendant owed taxes and intentionally evaded paying those taxes. Additionally, the government must show that the defendant willfully misrepresented or concealed material financial information for the purpose of evading a tax duly owed.”

Dippin’ Donuts, not to be confused with Dunkin’ Donuts, has been a local hot-spot for coffee and doughnut lovers in Oneida County for more than a decade. With locations in Rome, Utica and New Hartford, the Zourdos family have built their personal empire one doughnut at a time.

Criminal Justice Professor of Practice Raymond Philo was a former New Hartford police chief. Philo used situations experienced on the job to provide depth to what he is teaching his students.

“Investigating tax evasion is a highly specialized type of investigation, requiring a unique skill set, with access to specialized information such as tax returns,” Philo said. “Tax evasion is a fairly common crime and occurs a lot in combination with other crimes. For example, when dealing in unlawful drugs, the illegal profits are often unreported and then become a separate federal crime of tax evasion.”

An increased presence in the community meant more revenue flowing in for Dippin’ Donuts. It was reported that John Zourdos used the hidden funds to purchase a 2001 Porsche 911 as well as a Rolex watch, according to the indictment filed against him and his family. The indictment also cites that the Zourdos family committed employment fraud by paying some employees ‘under the table.’

While the punishments for tax evasion schemes vary, the Zourdos family can expect to pay hefty fines while also facing potential time behind bars.

“The IRS has two routes that they use to pursue tax debtors: civilly or criminally,” Hyman said. “If they pursue criminal remedies, the maximum sentences are as follows: Failure to file a tax return – up to 1 year in jail and a maximum fine of $25,000 for each year the taxpayer failed to file. Filing a false return – up to 3 years in prison and a maximum fine of $100,000 for each fraudulent return. Tax evasion – up to 5 years in prison and a maximum fine of $100,000.”

A court date is expected to be announced soon, according to prosecutors.