A report from Business Insider in 2017 claimed that 20- 25 % of shopping malls in the United States would crash between 2017 and 2022 and that retailers within these malls will close approximately 8,600 stores by 2019.

Fast forward to 2020, and Forbes claims that there are about 1,200 shopping malls left standing in the country. These malls don’t have to be functioning to be included in the statistics. Malls these days don’t have to be used for the shopping experience of the consumerism period in the 80s; most, in fact, are rented out for office space or even for low-income housing.

The New York Times brought in an example from 2018 about a mall in Los Angeles within the Google Complex to be reconverted into office space at a price tag of $418 million to run per year.

The reasoning behind the overall decline of malls spreads out to several factors. Utica College Economics Professor Richard Fenner believes these factors have been happening for years, and the hammer came down for most during the COVID-19 pandemic.

“You have the combination of anchor stores such as Sears and J.C. Penney that have proven to be non-viable options,” Fenner said. “If we were to localize this as well, look at how many malls are in one specific area in both Utica and Syracuse. There’s too much occupying one space. And, of course, the start of the pandemic hit hard because malls were one of the last areas of retail that could open back up.”

As the New York magazine predicted, about 20-to-30 percent of shopping malls experienced “severed limbs” during the pandemic. According to the publication, the mall, like an organism, decays once too many limbs have been cut off.

This claim was confirmed by The Buffalo News when malls in that region were allowed to open back up, only 50 people came through the door throughout the entire day in late April.

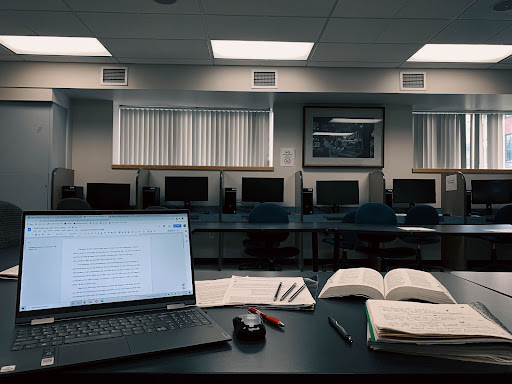

“I never go to the mall here in Utica because to be frank, I think it’s just a bad shopping experience,” senior Lindsay Rasmussen said. “I’d rather just go to Walmart and Starbucks, all of which are in the same complex, and shop for what I need in one swoop. The prices are cheap and there’s simply more of a selection.”

The solutions for malls seem to involve drastic measures. Properties that cost millions of dollars to keep functioning for a low return on investment involves sudden change, something Fenner believes can be driven through applying a niche to the shopping experience.

“Malls need to hold on to what they can,” Fenner said. “Once malls start losing too much space in a short period of time, it’s not a good look. Malls also need to find their niche; what brands and stores can help bring customers through the doors. And, of course, malls need to find a way to combat online shopping.”

YouTube creator Dan Bell, the host of The Dead Mall Series, did a special episode on the Bal Harbour mall in Miami. The mall, according to Bell, is filled with luxury brands and filled with upper-class shoppers on a regular basis.

The mall, in fact, makes so much money that it’s actually planning to expand their property over the next few years which involves buying a church that neighbors the shopping center.

The niche here is to target the upper-class, but Fenner believes ideas like this need to be boiled down to work in Upstate New York.

“Whatever the niche is for a mall in our area needs to match the income level the property is serving,” Fenner said.

The bottom line? Malls, according to Fenner, are too expensive to take down and too expensive to keep up if there’s not enough money coming in. It’s the fine line for malls that needs to be explored to keep the property value up, even if that means renting out the property for housing or office space.

“Any economic activity is better than nothing,” Fenner said.