The coronavirus (COVID-19) pandemic has brought an influx of tragedies and challenges to our society. As the U.S. approaches the one-year mark since the first positive case was discovered in the country, the nation now is entering a mad dash to slow the spread of the virus and vaccinate as many people as possible.

Not only has COVID-19 damaged people’s health, but it has also threatened to ravage the economy. Unemployment rates last year reached a sky-scraping 14.8% in April 2020 – higher than it was during the 2008 recession. Businesses closed their doors and people were either forced to work in the safety of their own homes or file for unemployment if their place of employment buckled to the test of the pandemic.

As unemployment rates soared, the U.S. government decided that citizens needed financial relief in order to manage the pandemic. Last April, former President Donald Trump signed off on the Coronavirus Aid, Relief, and Economic Security (CARES) Act in an effort to provide Americans with monetary assistance.

In December, after increased demand from citizens, Trump signed off on the second wave of stimulus checks, this time at a lower dollar point.

“The first stimulus check provided $1,200 per adult and $500 per child for families with under $150,000 in adjusted gross income,” said Rick Fenner, professor of economics. “The stimulus amount was reduced for people that earned more than that. The second round provided $600 per adult and $600 per child. The primary justification for the checks was for the government to compensate people for lost income due to the pandemic.”

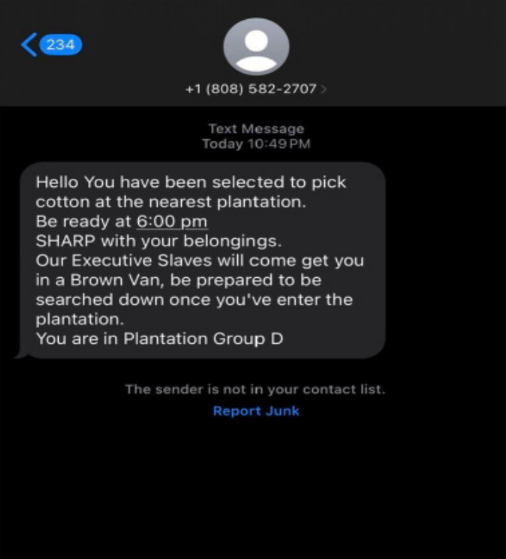

While stimulus checks have helped thousands of people negatively affected by the pandemic, they seemed to have missed a very large demographic that arguably could have used them the most. College students were seemingly left out of the mix, as stimulus funds were not provided to dependents over the age of 17. With a majority of college-aged people being claimed by their parents as dependents during tax season, families with children aged over 17 did not receive funds from the government.

“I think it was unfair,” said Katie Delgado, a junior studying therapeutic recreation. “I didn’t receive any of the two stimulus checks. We pay so much to attend college and we spend so much money trying to develop a life of our own yet we weren’t even considered to receive money like everyone else. It’s like we didn’t exist to the government.”

According to Forbes, there are very few loopholes that college students can wiggle through in order to receive a stimulus check. Only if a college student is under the age of 17 – less than 0.1 percent of undergraduate students are under the age of 17 – can their parents, not the student, receive a check on their behalf.

“Unfortunately under my circumstances, I did not receive any of the first two stimulus checks due to my parents claiming me as a dependent on their taxes,” said Leah Scalise, a senior studying business management. “I was very upset that I didn’t receive the check because I did temporarily lose my job to the pandemic and I do pay all my bills myself. I didn’t find it very fair the way the government chose who was eligible and who wasn’t.”

It is arguable that the first two stimulus checks were somewhat flawed. Some people did not receive them right away, while others received them who maybe should not have.

“In my opinion, the problem with the stimulus checks is that they weren’t targeted to individuals or families that were hurt by the pandemic,” Fenner said. “Many people that received them still had their jobs and hadn’t suffered any economic loss. While it is quicker and easier to send out checks to everyone, we could have provided more money to those people that truly needed it, if we had developed better criteria for receiving the checks.”

When newly-elected President Joe Biden first took office, he vowed to release a third wave of stimulus checks, this time aimed at higher funds reaching more people. The Biden administration plan would cost roughly $1.9 trillion while Republicans have countered this action with a package worth $618 billion.

According to The Wall Street Journal, both citizens and dependents, including those of college-age, would receive checks in both the Democratic and Republican plans. The difference dividing the two is that dependents would be eligible for $1,400 under the Democratic plan and only $500 under the Republican plan.

While the idea of ‘free money’ sounds enticing, as the old saying goes, there’s no such thing as a free lunch. Americans should prepare for higher taxes down the line to compensate for the billions of dollars that were handed out.

“These checks – and the rest of the stimulus package – will require either higher taxes in the future or a reduction in other spending, but that doesn’t mean that they aren’t a good idea,” Fenner said. “Most economists believe that the government has a role to play in the economy when businesses and individuals are not able or willing to spend enough and that is exactly what has happened during the pandemic. The stimulus checks, in addition to the expanded unemployment benefits and other government programs aimed at stabilizing the economy, can end up costing us less than if the economy continued to decline and more businesses were forced to close, thereby creating even more unemployment.”

The possibility of a third stimulus check has yet to be confirmed, as it is still being debated by our government. The likelihood of the Democratic plan being passed is high, considering that the Democrats control the Senate, as well as the presidency.

“I think the third wave of stimulus checks will really help the American people during the pandemic because everyone is in very different scenarios, whether they are personally affected or not,” Scalise said. “Bottom line is that every single American is affected by this virus, and I think even though I did not receive the first two checks, they really helped all American families during such a chaotic time.”