President Biden announced debt forgiveness: what this means for Utica students

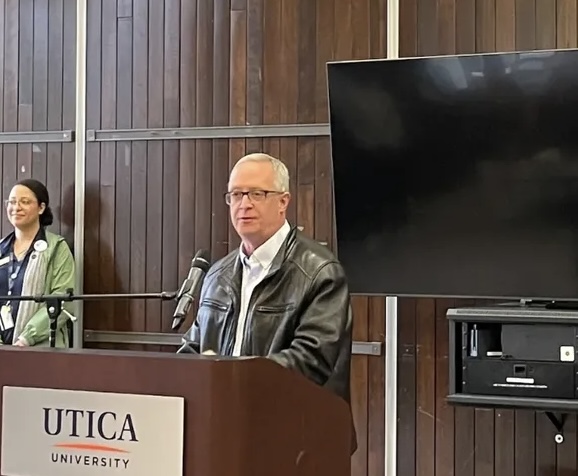

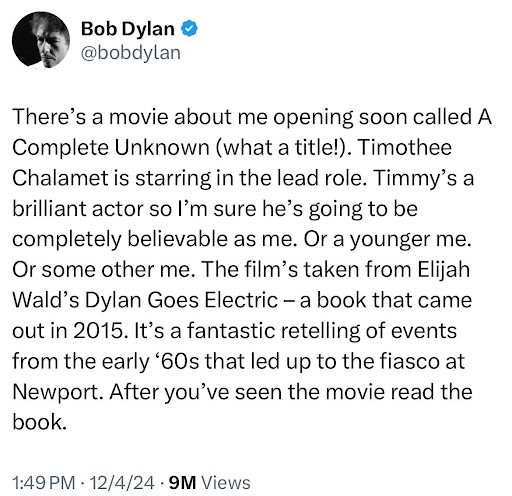

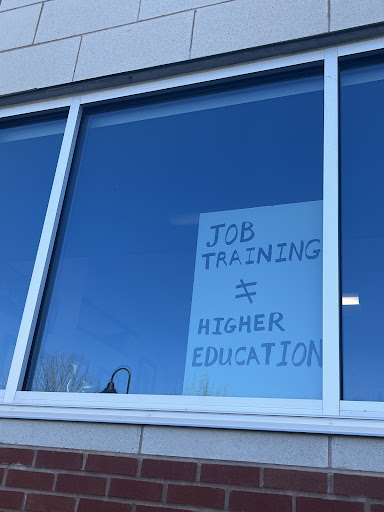

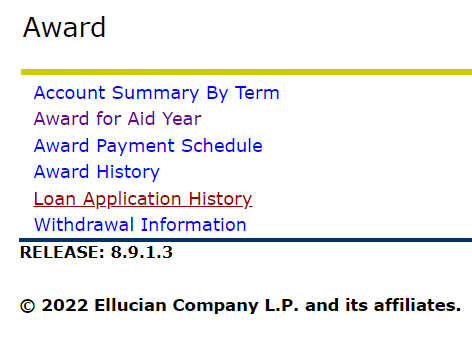

The section on Bannerweb that shows students their financial awards.

September 12, 2022

Last month, President Joe Biden announced the potential for a student loan debt relief program broken into three parts that will affect potentially millions of students and loan holders across the nation.

This debt forgiveness program will forgive between $10,000 and $20,000 for loan holders depending on financial situations and amounts held in loans. A sizable number of Utica University students may be impacted by this decision.

The first part of the program is the final extension of the interest freeze currently in place for federal loans. For students at the university, this means that anyone who has unsubsidized federal loans which are dispersed will finally start to accrue interest whereas they have not been currently.

Second is the mass student debt forgiveness which will directly affect those who currently hold federal loans.

Amounts of forgiveness that students will receive depends on what type of financial aid has been received throughout their college tenures. Students who receive Pell Grants, which make up around 60% of the student population according to an article by CNBC, can receive up to the full $20,000.

To find out if you received a Pell Grant, the information can be found through Bannerweb when looking at financial aid breakdown received in this and previous academic years.

In addition to students receiving forgiveness it is also noted in the plan that parent Plus Loans will qualify under the program.

“That includes Direct Stafford Loans and all Direct subsidized and unsubsidized federal student loans. Under the Direct program, Parent Plus and Grad Loans are also eligible for the relief,” according to the CNBC article.

The third phase of the this plan is to lessen the burden on future and current borrowers with a decrease in the amount that will be owed each month, lessen the potential burden of interest if monthly payments are being made and allow for potential forgiveness on federal loans after 10 years of payments according to the White House website.

Across campus consensus seems to be excitement surrounding the thought of loan forgiveness and a less strenuous debt load after graduation.

“I think it will have a positive impact on society as student debt is crushing many,” psychology major Sarah Dziegiel said. “The cost of living is going up and getting out of school with a cloud of debt attached to you is debilitating. Hopefully, this can be a step in the right direction.”

The largest focus from students seemed to be the long term effect of giving more people the ability to go to college and the hope that this will motivate others to try for higher education.

“When I found out I thought it was a hugely positive thing,” said Kayden Lamphere, an English education dual major. “I haven’t looked into it myself quite much yet but I know it is definitely something that is going to help out a lot of people and I am very excited. Some people don’t attend college because of the financial woes it might bring, a good opportunity.”

While there is a lot of positive buzz on campus about the plan, there are still questions regarding details of the plan that have been made clear to the public yet. A large one is how financially this will impact the country and if it will have some sort of effect on taxes.

“Having this program already might make more people come to college and want a better education,” Lamphere said. “I know there is a big question around taxpayer money, but personally knowing it will help so many more people attend college is worth it to me.”

Besides potential financial effects there is also the question of forgiveness beyond federal loans.

“The only thing I wonder is if there will be anything for those who have a majority of their debt in private loans,” Dziegiel said. “I personally know a lot of students whose parents on paper make a decent middle-class living therefore they do not receive a lot of government aid or loans causing them to have to resort to private loans in order to pay for their education.”

At this moment there is no forgiveness in place though this plan will impact privatized education loans held by students.

“I didn’t need to know all of the logistics to feel happy about even a fraction of the weight of student debt possibly being lifted,” Dziegiel said. “After reading up about it, I am grateful our country is starting to recognize the crisis of student debt.”